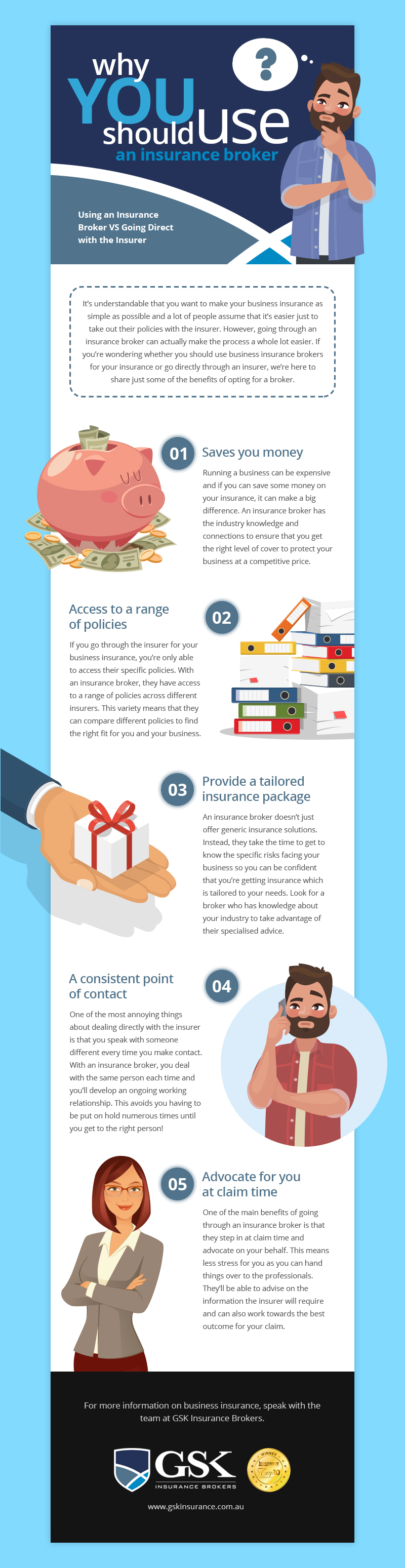

It’s understandable that you want to make your business insurance as simple as possible and a lot of people assume that it’s easier just to take out their policies with the insurer. However, going through an insurance broker can actually make the process a whole lot easier. If you’re wondering whether you should use business insurance brokers for your insurance or go directly through an insurer, we’re here to share just some of the benefits of opting for a broker.

Saves you money

Running a business can be expensive and if you can save some money on your insurance, it can make a big difference. An insurance broker has the industry knowledge and connections to ensure that you get the right level of cover to protect your business at a competitive price.

Access to a range of policies

If you go through the insurer for your business insurance, you’re only able to access their specific policies. With an insurance broker, they have access to a range of policies across different insurers. This variety means that they can compare different policies to find the right fit for you and your business.

Provide a tailored insurance package

An insurance broker doesn’t just offer generic insurance solutions. Instead, they take the time to get to know the specific risks facing your business so you can be confident that you’re getting insurance which is tailored to your needs. Look for a broker who has knowledge about your industry to take advantage of their specialised advice.

A consistent point of contact

One of the most annoying things about dealing directly with the insurer is that you speak with someone different every time you make contact. With an insurance broker, you deal with the same person each time and you’ll develop an ongoing working relationship. This avoids you having to be put on hold numerous times until you get to the right person!

Advocate for you at claim time

One of the main benefits of going through an insurance broker is that they step in at claim time and advocate on your behalf. This means less stress for you as you can hand things over to the professionals. They’ll be able to advise on the information the insurer will require and can also work towards the best outcome for your claim.

Let our brokers do the work for you – give us a call

Interested in these benefits? If you’re looking for business insurance brokers in Perth, GSK Insurance Brokers are here to help. We are leading insurance brokers in Australia and our loyal client base stretches across the country.

If you want the hassle taken out of insurance, our experienced brokers are here to ensure everything goes smoothly. Our experienced team of insurance professionals will analyse your business so you can be confident that your specific areas of risk are covered. For tailored insurance solutions, speak to one of our brokers today. Contact GSK Insurance Brokers on (08) 9478 1933.